It's never too early to invest in your future

NYU professor Scott Galloway's latest book should be required reading for recent college graduates or anyone early in their career.

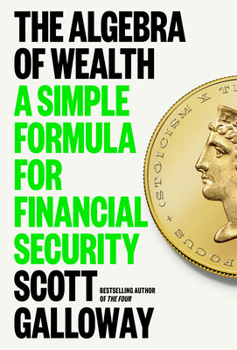

The Algebra of Wealth: A Simple Formula for Financial Security

By Scott Galloway

“This is one of the most important books any soon-to-be-graduate or recent graduate can read to help jump start their careers.” —My advice to several friends, whose kids are recent graduates, after reading the book.

In 2021, while taking my daughter to Cross Country practice each weekday morning, I started listening to podcasts instead of the music I listen to in the gym. As a huge behavioral economics (business + psychology) fan, I naturally gravitated to my favorite authors’ podcasts.

One such author was Scott Galloway, a marketing professor at NYU’s Stern School of Business and a tech entrepreneur. Aside from being funny and brilliant, his candor on all things business and personal have made him weekly listening for more than five years. Galloway’s podcast, blog, videos, and books are best-in-class, entertaining and educating readers and viewers nonstop.

His latest book, though, The Algebra of Wealth: A Simple Formula for Financial Security, is one I’ve been waiting for, primarily because his advice on selecting careers by prioritizing what you’re good at instead of passionate about is something I don’t find discussed often enough among parents, students, and recent graduates. Additionally, as an avid reader of his blog, I’ve been eager for him to share his advice and expertise on investing in a more condensed, succinct fashion, which he does in with The Algebra of Wealth.

What I enjoyed most: Using his vast experience as an entrepreneur and educator, Galloway provides readers of all ages with a roadmap to achieving financial stability, and he does so while laying the book on an intuitive, easy-to-read fashion.

The greatest benefit to readers: His soup-to-nuts coverage of all things related to prosperity—goal-setting, education, advice-taking, career choices, social media use marriage, investing, etc.—helps to create a book full of valuable advice.

A few of the most indispensable points he makes are as follows…

‘Form a kitchen cabinet’

“Your kitchen cabinet will be who you turn to when you need career advice, second opinions on both business and personal decisions, and generally people to bounce ideas off of.”

Respect the most important economic decision you’ll make—who you’ll partner with.

From an economic standpoint, getting—and staying—hitched is one of the most beneficial things you can do. Married individuals are 77% weather…and each year your married , your net worth increases 16%.”

‘Don’t follow your passion’

This, selfishly, was one of my favorite areas of the book, in large part because I’ve heard Galloway talk about this in the past, and his advice is spot-on.

“Your mission is to find something you’re good at and apply the thousands of hours of grit and sacrifice necessary to become great at it. As you get there, the feeling of growth and your increasing mastery of your craft, along with the economic rewards, recognition and camaraderie, will make you passionate about whatever ‘it’ is.”

Instead, he says, follow you talent.

“Talent is anything you can do that others can’t or won’t.”

(Readers will be very surprised at what the skill the author thinks of one of the biggest “accelerant[s]” for any career. Hint: It does not involve technology or even require any formal education.)

Be judicious in your use of social media

“Social media is likely one of the great wealth destroyers in history. It robs young people of years of time when they need it most—when investing in work and (real) relationships can compound.”

I love the approach he’s adopted for how he spends his time:

“I’ve reallocated all of [my] capital into two things: trying to be the best in the world at what I do for money; and doing more of the things I do for joy.”

Also worthwhile

The latter half of the book, under headings Time and Diversification, covers budgeting, saving and investing and taxation. While young readers might find the reading a little heavier, Galloway’s entertaining writing style and the importance of the topics warrant thorough perusing—and note-taking.

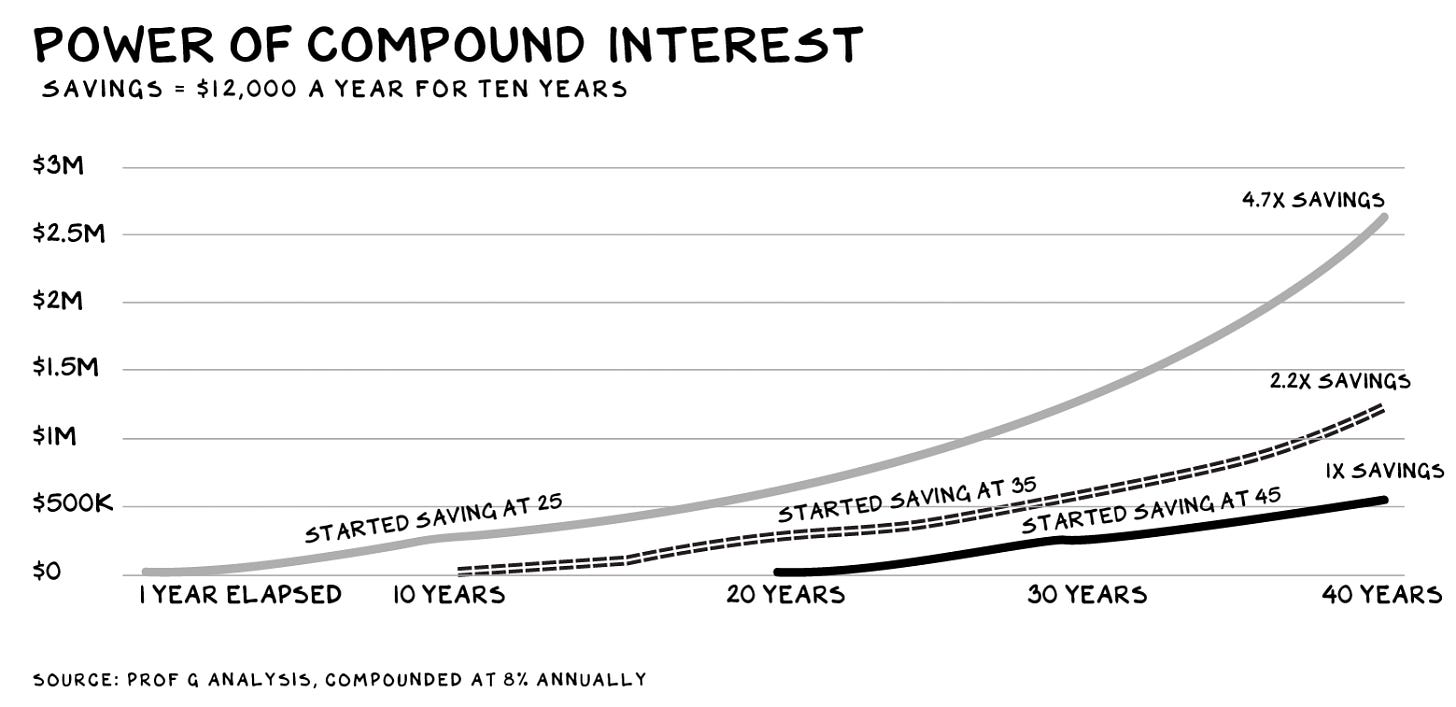

I’ve always appreciated his wisdom when discussing real estate, stocks and the market overall, but what I found most valuable in The Algebra of Wealth was his driving home of the need for young readers to start saving and investing early for reaping the benefits later on.

“If you invest $12,000 per year at 8% [beginning at age 25], then you will have $2.5 million when you turn 65. Warren Buffet accrued 99% of his wealth after age 52. Investing is like planting oak trees. The best time to start is ten years ago. The second-best time is right now.”

Young readers would also be wise to invest in The Algebra of Wealth.

Why I highly recommend the book

I suggest anyone looking for a well-written, entertaining, and illuminating book to pick up The Algebra of Wealth. The advice applies doubly so to recent graduates. Galloway’s writing style helps to distill invaluable insights they can use to build a financially rewarding future.